This is the first of several articles I’ve created to share some of those books and ideas with you. I hope you find them as useful as I have.

– Josh

My youngest two daughters are still at the age where they prefer to share a bed. Most nights this doesn’t interfere with going to sleep. Only occasionally do they erupt into uncontrollable giggle fits or decide to fight over a stuffy.

One evening not too long ago my wife joined them in bed to snuggle and read before lights out. With the middle – E – quietly reading beside them, my wife asked the youngest – C – if she ever wanted her own bed.

“Yes,” replied C, “but I’ll miss playing doll with E.” “Oh, that’s ok, you can always play dolls before bed or when you’re awake,” replied my Wife.

“Not ‘dolls’ Mommy,” C corrected her. “Doll. When E goes to sleep before me, sometimes I move her arms and legs around to make it look like she’s running. Or I’ll put her in different funny positions. Or I’ll make her hit herself in the face. She never even wakes up!”

Shocked into silence, my wife turned to look at E… only to find her staring at C in wide-eyed terror, realizing at the same time as her mother that she was sleeping next to a monster!

“Don’t do that!” my wife blurted out incredulously. “It’s ok,” said C in a perfectly reasonable tone, “she never wakes up. It’s so, so funny, and plus, she never wakes up!”

[I want to pause here and say that it’s at this point during my wife’s re-telling of this story that I fell laughing in the kitchen floor. If there was no more to this story – if there was no ‘lesson learned’ or redemptive quality at all – I would be ok with it.]

At that point my wife realized she was no match for C’s logic. The only way to prevent this from happening again – and to create the possibility that E would ever feel safe going to sleep in the same room as her sister again – was to paint a bigger picture for her, the “why” behind the “what”.

“That’s not the point, C, she’s not a toy, she’s your sister. Sisters are supposed to protect each other and make each other feel safe. E doesn’t feel safe with you if she thinks you might be playing with her like a doll when she’s asleep. How would that make you feel?”

Fortunately, this was enough to convince C that playing doll with her sister wasn’t such a good idea. She apologized to her sister, they made up, and no one is bothering each other in their sleep anymore (as far as we know).

Ok, what does this have to do with Credit Unions?

As adults, it’s so easy to get stuck on the day to day “whats” – the to-do list, email inbox, mobile alerts, random phone calls, the “don’t play doll with your sister’s” – that we lose sight of the “why” that should be behind it all. That’s because most of the items that keep us busy weren’t created by or prioritized by us.

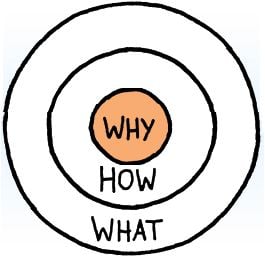

In his book Starting With Why, author Simon Sinec argues that “Inspired leaders and organization… think, act, and communicate from the inside out: Why – How – What. They first understand why they exist, the emotional core of what drives them. Then they determine how to reach that goal, and lastly, they do what they do.”

If we will take the time to identify and internalize our “Why”, the emotional core of what drives us, we will have a critical tool for both identifying the “what’s” we should focus on, and how to prioritize them.

Why this important to Credit Unions

In an industry providing services that are almost commodities – I can set up a checking and savings account with half a dozen banks and credit unions in one afternoon – trying to convince people to join the CU Movement based on our “what’s” is not a sustainable option.

I firmly believe the Credit Union “why” – however you decide to articulate it – is so compelling that if Credit Unions chose to fully embrace it in all aspects of their business the CU Movement would see unprecedented growth.

Attracting Members

The goal of leading with your Credit Union’s “why” is not to do business with everyone who needs what you have; the goal should be to do business with people who believe what you believe. Why? Because members who align with your Credit Union’s “why” are loyal, vocal, and often as committed to helping you reach your goals as you are. People are attracted to people who believe what they believe. Said another way, “People don’t buy what you do, they buy why you do it.”

Attracting Talent

This is also true of employees. Says Sinec, “Don’t hire people who need a job; hire people who believe what you believe. If you hire someone for a job, they will work for your money. If you hire people who believe what you believe, they will work alongside you with energy and passion.”

Before you can get people to respond to what you are asking them to do, you must clearly know why you are doing it. If you talk about what you believe, you will attract people who believe the same things.

Only after clarifying your “Why” can you move on to weeding through – and prioritizing – your “What’s”.

I highly recommend making time to read Sinec’s full book. Get a good overview you can also listen to his 2010 TED Talk HERE.